It is a valuable practice to periodically contemplate personal and professional achievements and more importantly plot the path towards the next goal, the next direction. These reflections can be thought of as a temporary ‘You Are Here’ arrow on your life’s map.

Image Courtesy of Creative Commons

I will leave it to your imagination and better judgment to build your list of accomplishments. They include many facets of your life: a recent award or promotion, a challenging but rewarding project, a recent sales/revenue plateau, family, community, the friends you have made and the vacations and trips that have filled your spare time.

It is pretty easy to get comfortable, complacent or maybe even smug about markers of your career and social advancement. As these mementos and trophies add up, they can also get in the way. Each risk taken or new venture tried represents a potential threat to your station in life.

We don’t have to go far to start listing threats. Our economy continues to struggle as we face the aftermath shocks of a financial market collapse and fluctuating currencies, a faltering Chinese economy, terrorism threats, loss of faith and trust in our political system, ethical and moral scandals in our biggest firms and the entry and exit of major Canadian companies. Cumulatively, these waves of shocks all affect investor confidence and the willingness to look forward enthusiastically.

Regardless of our belief in the ability to control the environment and the stability of our situation, change is necessary. We are in a very complex environment of moving parts driven by technologies, digital and internet applications and their transformative impact on our work. The impact often may be seen as putting up barriers to participation in the economy or conversely, opening up doors of opportunity.

Reports from think tanks and the research departments of large professional service firms routinely forecast massive changes to the structure of many industries fuelled by new and converging technologies, new and improved business models (see also McKinsey) , promising to deliver efficiency, economy and widespread access and connectivity. As these forecasts sink in and narratives start to drive your imagined portrait of the future, it begs the question – what do I do with all this information? What can I take advantage of to thrive and navigate my growth?

A feasible approach is offered by Nassim Nicholas Taleb of The Black Swan fame. His follow up book, Antifragile explores things that gain from disorder. He recognizes, “the resilient resists shocks and stays the same; the antifragile gets better". A key concept he introduces is hormesis (the ability of organisms to become stronger when exposed to low-dose stress). It is one example of mild antifragility, where the stressor is a poisonous substance and the antifragile becomes better overall from a small dose of the stressor. Taleb emphasizes depriving systems of vital stressors can be downright harmful. The ancient Greeks used this technique to avoid harm from poisons that might be administered to key political actors as a way to solve sticky governance problems. A savvy potential target might take increasingly larger doses of poison to build a tolerance and thus avoid the inevitable. Today, the same logic can be seen in practice with vaccines.

How do we use this idea in an era of great uncertainty and constant flux? We must learn how to make our lives (political systems, social policies, finances, etc.) not merely less vulnerable to randomness and chaos, but actually antifragile — poised to benefit or take advantage of stress, errors and change, the way, say, the mythological Lernaean Hydra generated two new heads, each time one was cut off.

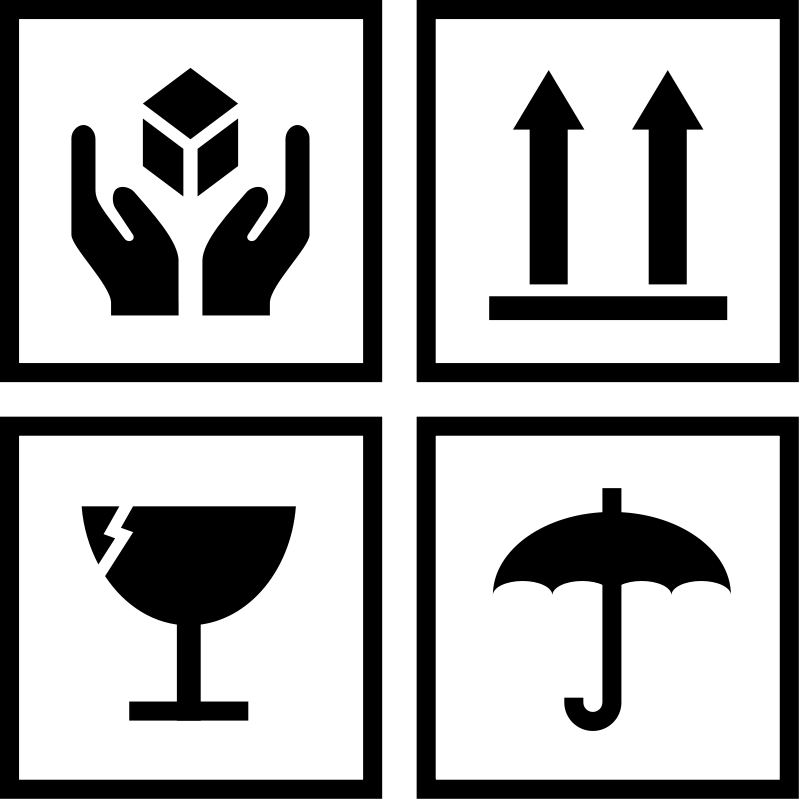

Please Mis-Handle!

Humans are antifragile — at least to a point. Our bones and muscles get stronger when subjected to the stresses of walking and lifting things — and they wither when they go unused. Bone and muscle development can be viewed as examples of hormesis. Is antifragility the same thing as hormesis? Or is it something more?

Image Courtesy of Creative Commons

Whether we like to believe that the world is ordered and controllable, disorder is inevitable in all closed systems. Anything that suffers when subjected to any form of disorder is fragile. That which is fragile does not age well or stand the test of time, and it is extinguished during times of increased volatility.

To illustrate – individuals are more fragile than families, organizations or societies. Firms–for example restaurants–can go out of business easily, while the restaurant sector of a city or country can persist and even improves after an economic downturn. Dynamic cities are more anti-fragile than firms, and competitive economies even more so. These larger economic units develop and continue to satisfy economic needs despite — or because of — the creative destruction that puts individual firms out of business.

Rather than reduce risk, as we like to do as consultants, what if we organized our lives, our business or our society in such a way that it benefited from randomness and the occasional unpredictable event. Using the example of restaurants, the restaurant sector is robust because the failure of any one restaurant does not affect the others. And the restaurant sector is antifragile because the remaining players actually learn and grow from witnessing the mistakes made by the failed restaurant. Now, compare this to the banking system. The world banking system is inherently fragile because the failure of one bank leads to contagion that can cause the failure of other banks and of the system itself.

Antifragility is not just of theoretical interest. It has great practicality. Not all individuals, organizations or societies are equally antifragile. If an entity can become more antifragile, it will become better able to withstand the stresses and insults of time. As we live in a time of increasing change, volatility or disorder, this is a discussion worth having!

In economics, we want to know more than just that free competition can lead to better products and services. Which specific practices make companies more resilient? The most interesting business books are not those that proffer abstract theories of competition, but rather those books like Jim Collins’ Good to Great that try to identify the features of companies that survive for decades, through good times and bad. We want to know the secret of what makes individuals, restaurants and nations thrive. It’s not enough to tell us that the successful ones are the survivors.

Some practical take-aways:

- Overcompensation - we go to the gym to get stronger. We should be thinking about overcompensating or building extra capacity and strength in anticipation for the possibility of a worse outcome, in response to information about the possibility of a hazard (in anticipation of the future).

- Don’t just protect on the downside - One of the hallmarks of fragility is that the downside is much worse than the upside. Rather than “diversify” into areas of average risk, one might pursue an “asymmetric” or lopsided strategy, which protects on the downside and has the possibility of great gain on the upside. Selecting a “safe“ career, and supplementing this with a wild, creative or fun avocation like writing, skydiving or playing in a rock band or combining occasional, high intensity weight lifting or interval training, alternating with long stretches of rest and recovery. The intermittent stress pushes the body to overcompensate and prepare for an even greater future challenge, but the interlude of rest and recovery is restorative and avoids the downside of chronic overuse.

- Invest in the upside - Accepting the idea that we should use the majority of our assets to protect solidly against the downside, how do we decide to invest our money, time, or energies to maximize the upside? If you can secure a rent-controlled apartment, you are protected against rent increases, but if rental rates go down elsewhere, you are free to move. In your contracts, insist on the option to cancel at will without cost. (Don’t sign up for long-term phone contracts!).

- Understand the long-term effects - Be careful to not be seduced by the promise of immediate and visible short-term benefits without understanding longer term or second order effects (it is often the case that the potential cost is much worse than the cumulative gains). We are overly impressed with relatively short-term studies that show some immediately visible benefit, and we are willing to gamble on this small upside for unknown longer-term effects. The downside of a novel intervention may not be known for years. We’ve learned that trans fats and high fructose corn syrup — originally thought to be harmless “innovations” to reduce spoilage or save money — contribute to obesity and metabolic syndrome. But it took decades for this to become clear.

As individuals and as a collective, we learn more from mistakes than from successes. For every failed business idea, our knowledge base expands. With this lens, there is no such thing as a failed entrepreneur or a failed scientific researcher. On a personal note, chart out your career and ask yourself objectively if you didn’t learn something from the poor decisions you made, the bad jobs you chose, the ill-designed business ventures and partnerships that you have in your history. While not a total economic Darwinist, I can see a lot of merit in the role of sacrifice in making the system, and us, stronger.

Sometimes, the source of our failure is outside of our control and building the capacity to deal with it (rather than dismiss the possibility) is just common sense.