Though on everyone's radar, I find many industries and cultures are challenged with understanding what the heck sustainability is... let alone whether it is worth our attention. This post is intended to provide a helpful perspective on sustainability as this topic is immensely valuable to management consultants, sponsors and project team members.

I remember in the 70s and 80s when it was the fiduciary responsibility of business owners to work with the local economy, business, suppliers and

- Risk Mitigation

- Asset Maximization

- Brand Protection

Let's look at each one of these in turn.

Risk Mitigation

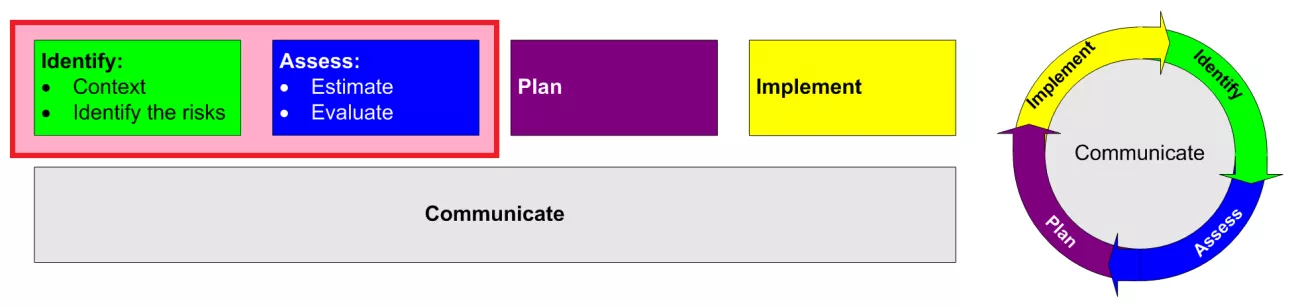

I focus a lot on risk management and mitigation. Once again keeping in mind that

Exhibit 1: Modified Sample Risk Management Method (OGC, p. 30 & 29, 2012).

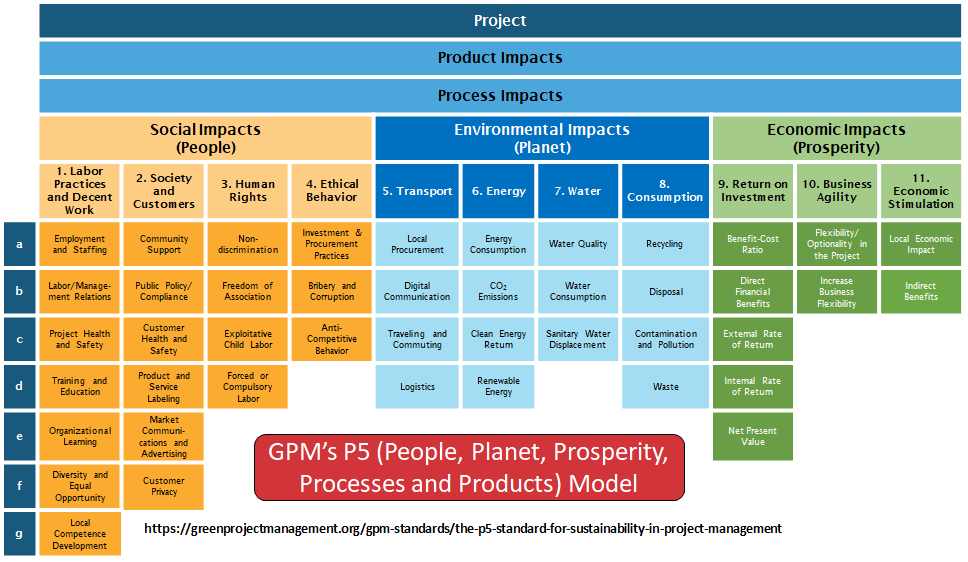

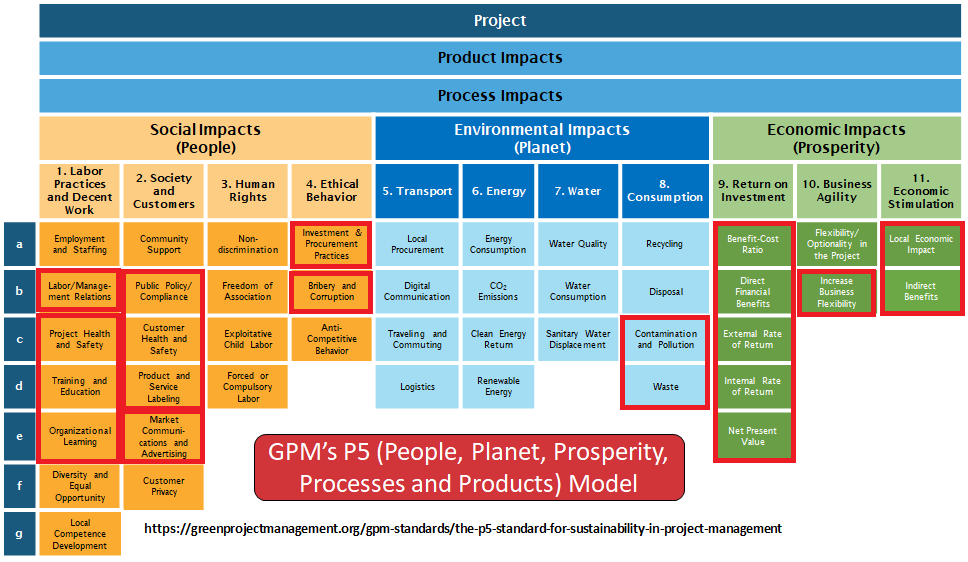

One excellent risk mitigation technique is to employ the GPM P5 Impact Analysis model to conduct internal and external project and organizational assessments to identify potential threats and opportunities and to prioritize those risks based on organizational priorities and potential impacts. More interestingly though, this model provides an excellent summary of what sustainability is and what questions to ask based on a simple paradigm.

Exhibit 2: GPM P5 Model

Presuming we have mitigated threats and exploited opportunities for our assets through the discipline of risk management, the next step is to continue those benefits through projects and operations by taking an asset maximization perspective.

Asset Maximization

ISO 55000:2014 Asset management — Overview, principles and terminology, defines assets as:

3.2.1 Asset: item, thing or entity that has potential or actual value to an organization (3.1.13) Note 1 to entry: Value can be tangible or intangible, financial or non-financial, and includes consideration of risks (3.1.21) and liabilities. It can be positive or negative at different stages of the asset life (3.2.2).

The benefits of asset maximization include, but are not limited to (ISO 55000:2014, page 2):

1. improved financial performance

2. informed asset investment decisions

3. managed risk

4. improved services and outputs

5. demonstrated social responsibility

6. demonstrated compliance

7. enhanced reputation

8. improved organizational sustainability

9. improved efficiency and effectiveness

I have highlighted some benefits above showing how integrated asset management is with risk, brand and sustainability,

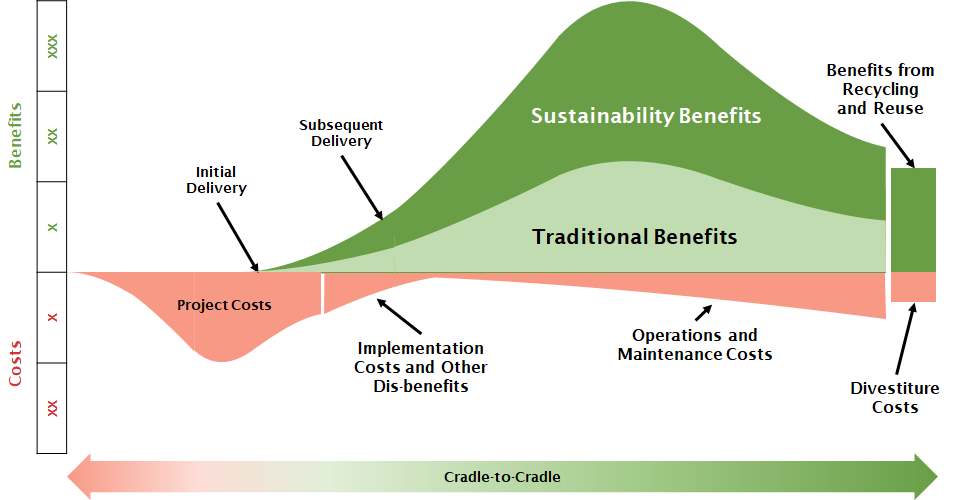

The maximization of assets is not a frequent reference in projects with the exception of engineering or engineering economic studies. The focus being on the cradle to cradle asset life-cycle of the new asset is a key component of project management and is tied to business case management and benefits management. Sustainability is a core component of asset management and helps maximize the assets by focusing on the full asset life-cycle cost, risks and benefits. This should be a primary consideration for management consultants and project managers and sponsors, due to the critical importance to the business case.

Exhibit 3: GPM Cradle to Cradle Asset Life-cycle Project Model

One of the fundamentals of asset management is value management, in that assets exist to provide value or worth to the organization and its stakeholders. “Asset management does not focus on the asset itself, but on the value that the asset can provide to the organization. The value (which can be tangible or intangible, financial or non-financial) will be determined by the organization and its stakeholders, in accordance with the organizational objectives” (ISO 55000:2014, page 3).

One can infer that by employing risk management and asset management we can help organizations protect their brand from threats from sustainability and social responsibility mistakes.

Brand Protection

The primary purpose of a brand is to increase the total asset value of the company/organization. One of the key concerns of brand management is

A brand is an ‘intangible asset including, but not limited to, names, terms, signs, symbols, logos and designs, or a combination of these, intended to identify goods, services or entities, or a combination of these, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefit/values.

Note: A Brand creates distinctive images, experiences and associations in the minds of Stakeholders, thereby generating additional value above and beyond the base expectations of the product or service in the category(

BP Gulf of Mexico Oil Spill

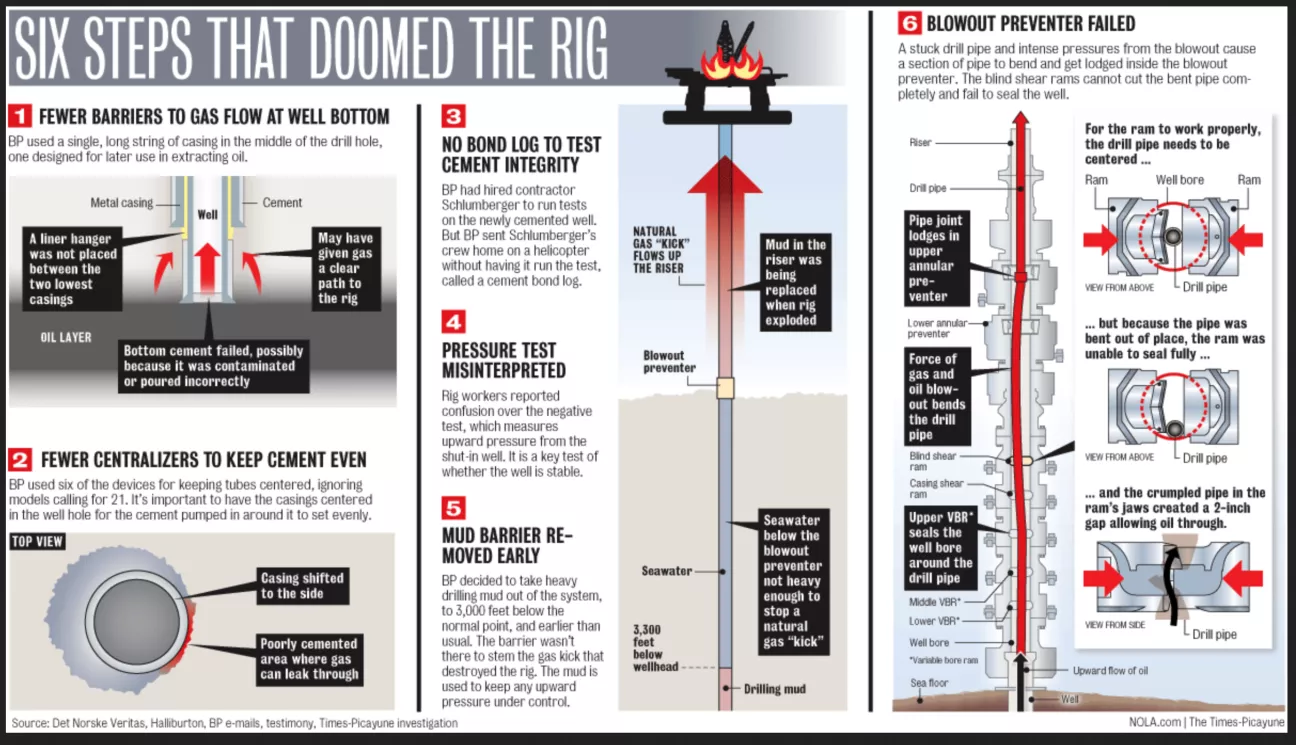

On April 20, 2010, a final cement seal of an oil well in the Gulf of Mexico failed, causing what has been called the worst environmental disaster in U.S. history and taking the lives of 11 rig workers.

Exhibit 4: BP Oil Gulf Spill Facts (Swenson, 2013).

On an after-tax basis, BP’s spill costs will amount to $44 billion with the additional charge of $2.5 billion in the second quarter, the company said.

“It’s a really scary number,” said Fadel Gheit, oil analyst at Oppenheimer & Co. “Before the accident, BP had a market capitalization of $180 billion. The accident actually shaved off one-third of the market capitalization of the company. It’s a miracle that the company is still in business.” (Mufson, 2016)

Due to foolish, short-sighted and unsustainable project decisions, BPs market capitalization was $180 billion until the accident shaved off one-third of the market capitalization of the company.

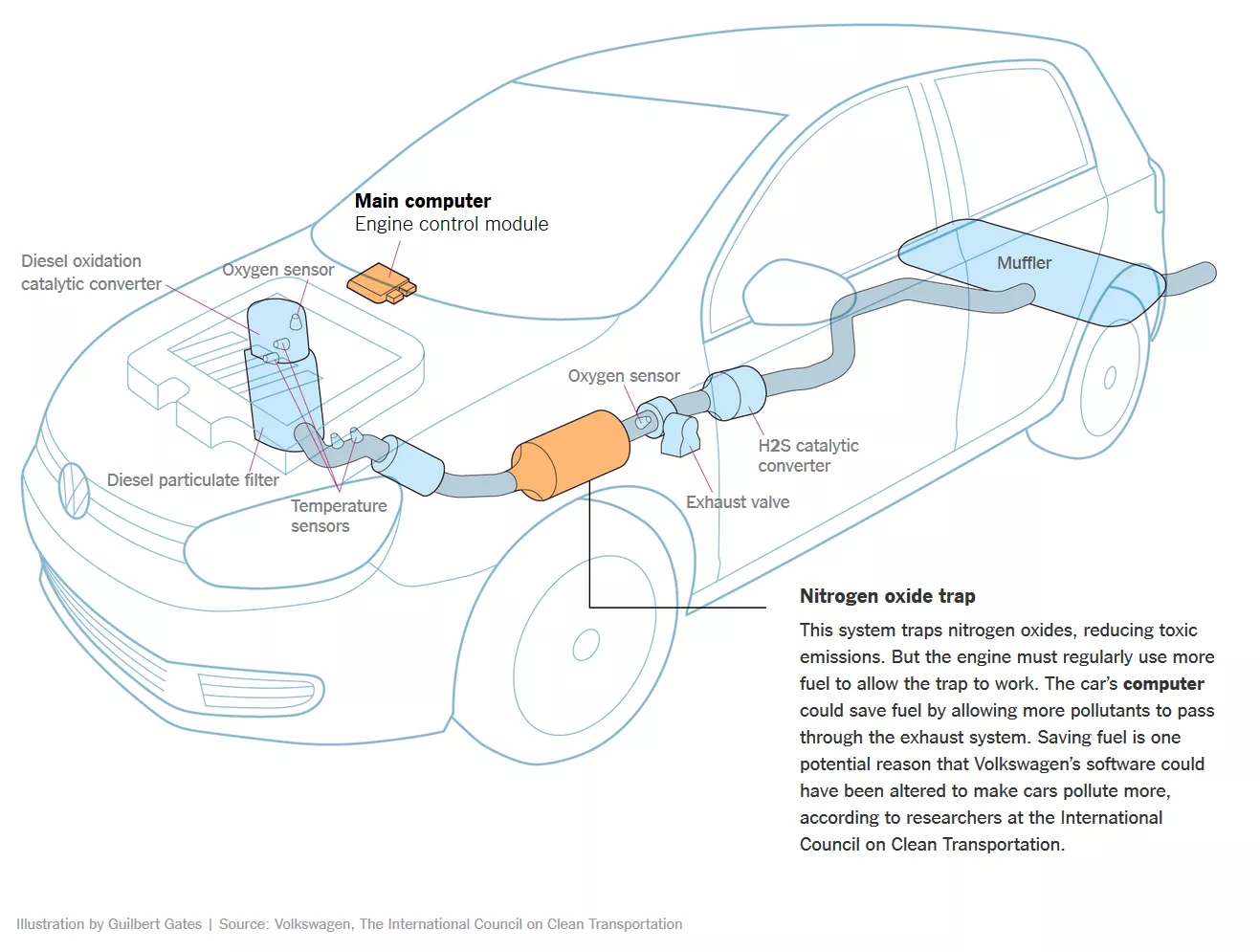

Volkswagen Emissions Scandal

“Volkswagen AG’s provisions for the diesel-cheating scandal rose to 22.6 billion euros ($23.9 billion), as the German car maker continues to tally damages from the worst crisis in its history” (Rauwald, 2017).

Exhibit 5: VW Emissions Scandal (Gates, 2015)

“All of a sudden, Volkswagen has become a bigger downside risk for the German economy than the Greek debt crisis,” ING chief economist Carsten Brzeski told Reuters.

“If Volkswagen’s sales were to plunge in North America in the coming months, this would not only have an impact on the

Once again, due to foolish, short-sighted and unsustainable project decisions, Volkswagen’s (VW) shares lost almost a third of their value, or about 22 billion euros ($24 billion), since it admitted in September to misleading U.S. regulators about emissions with the help of

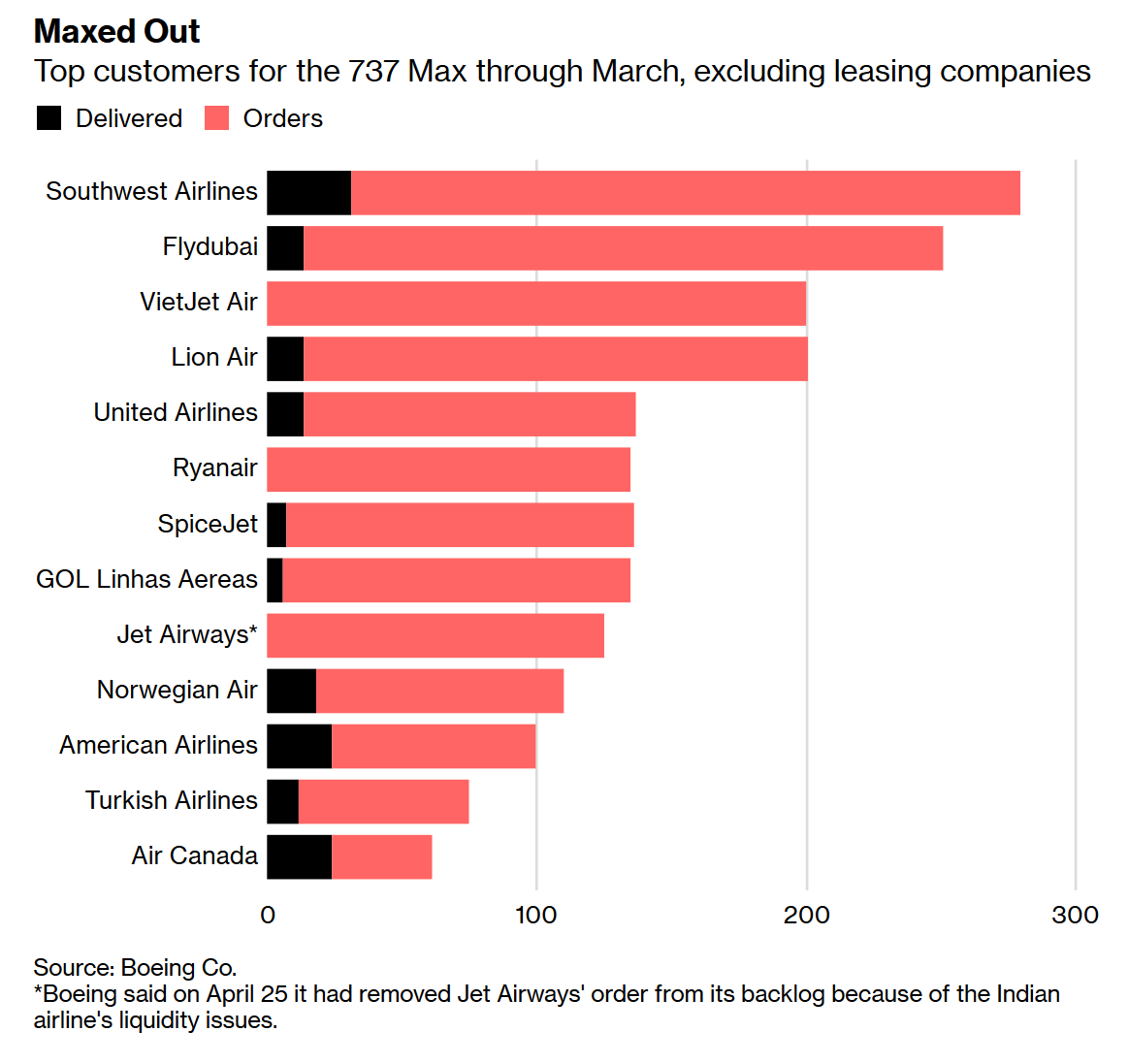

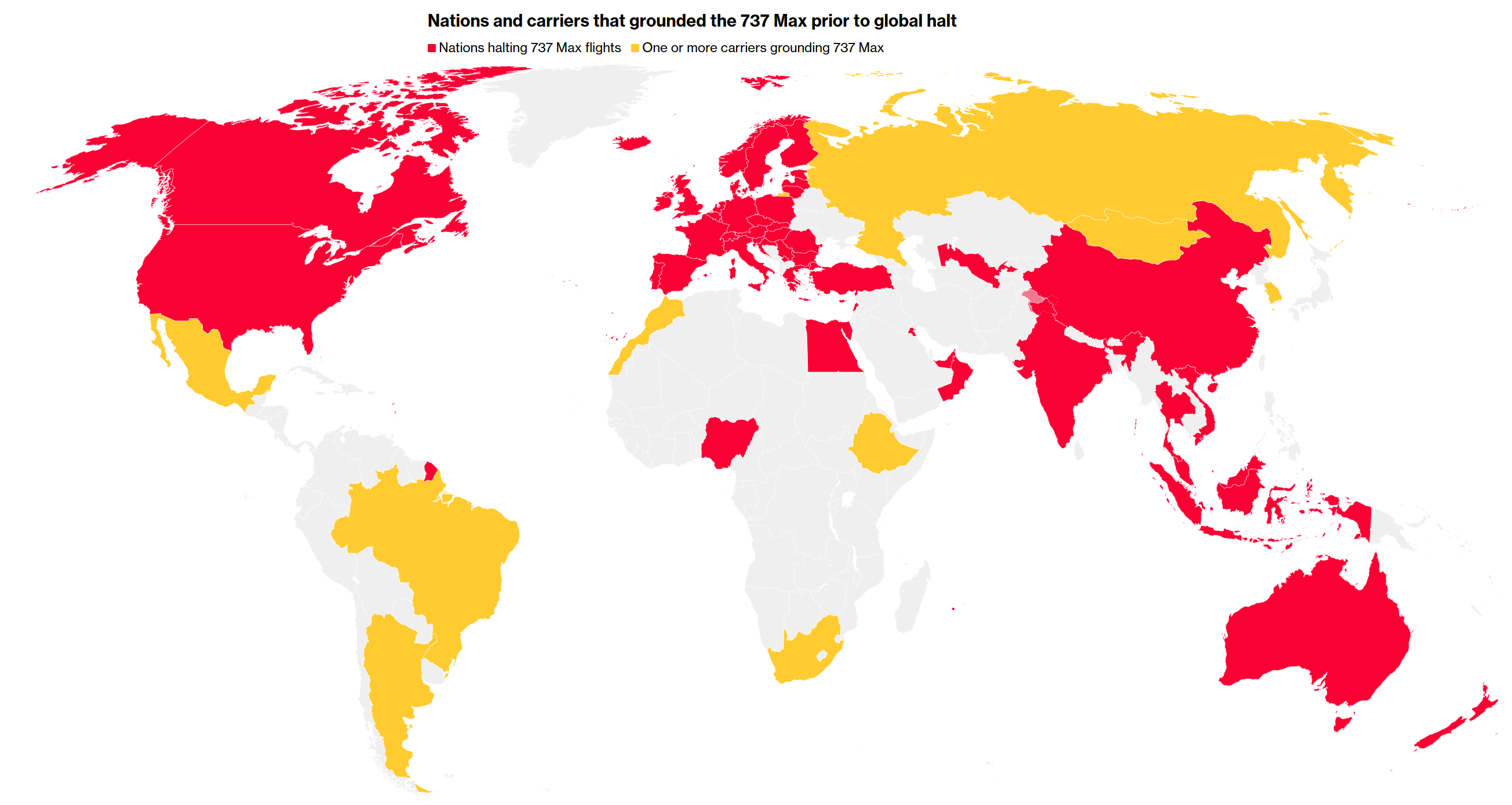

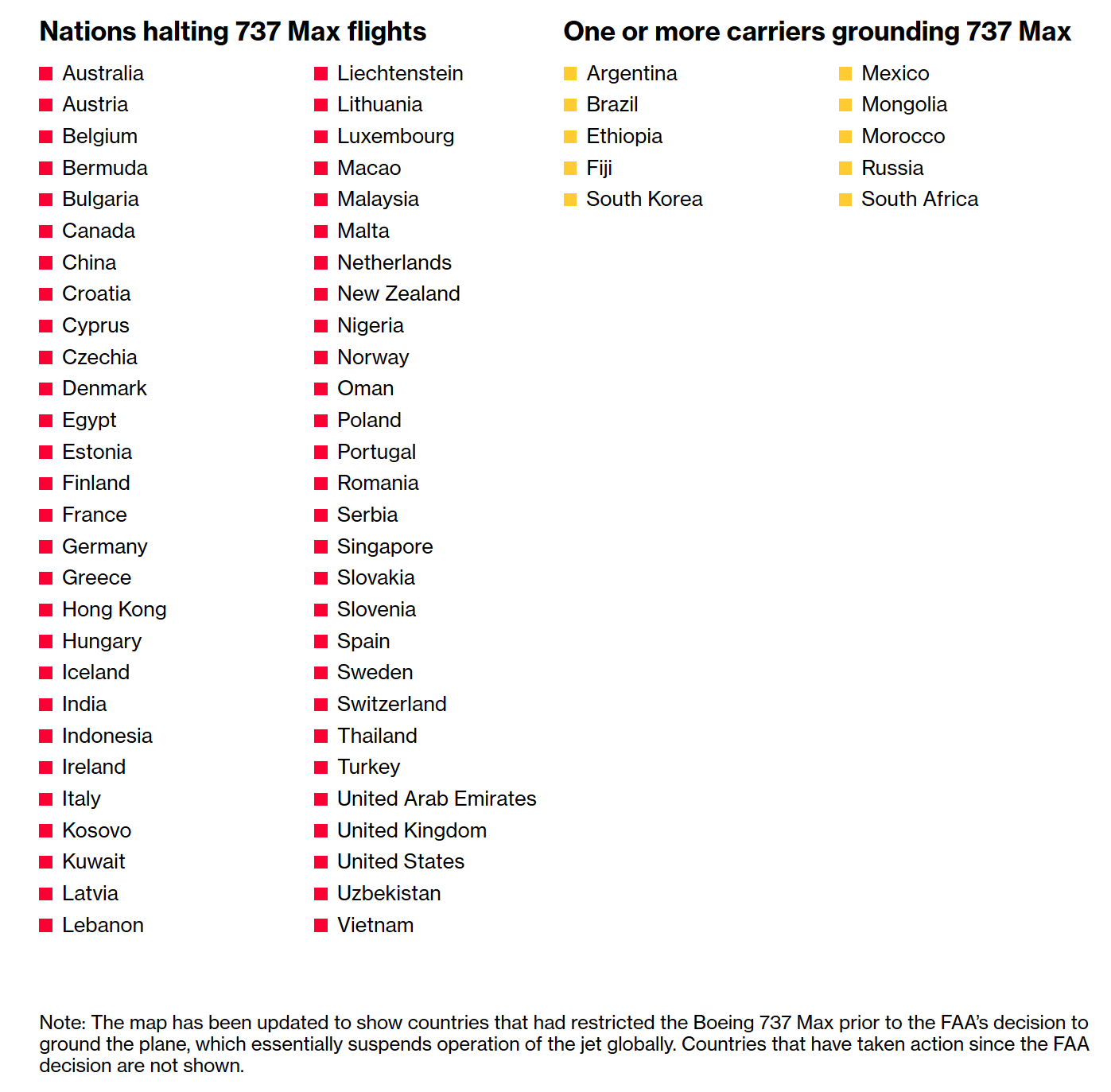

Boeing 737 Max Disasters

Like BP's Deepwater Horizon oil spill, Volkswagen' emissions cover-up, and Toshiba's inflated profits (one can go on and on with additional examples) the Boeing 737 Max disaster is a clear case study of the dangers of avoiding sustainability in projects. Despite libertarian perspectives, there is a reason to pay for independent government agencies to assess and audit key industries, as the FAA was supposed to with the Boeing 737 Max. This is a social and economical sustainability failure.

In the past year, as of the writing of this post, within five months of each other two "brand-new 737 Maxes have plunged to earth, befuddling their pilots and costing three hundred and forty-six people their lives" (Cassidy, 2019). The simple

At a minimum, even a preliminary sustainability assessment would have raised the following threats requiring mitigation with an unstable plane design (Travis, 2019), with poor protective measures (Travis, 2019), poor training (Liebermann, 2019), and actually charging extra for basic safety features so as some airlines would not purchase them (Tabuchi, 2019) leading to two crashes with massive financial and reputational impacts:

Exhibit 9: GPM P5 Assessment of Boeing's 737 Max Disasters

Once again, due to foolish, short-sighted and unsustainable project decisions, the cost to Boeing has been noticeable (Park, 2019):

- There is the prospect of substantial payouts to the families of passengers if Boeing is found responsible for the crashes.

- In the week after the second crash, Boeing lost more than $22 billion, or 12 percent, of its market value.

- In April, the company missed its quarterly earnings estimates for just the second time in five years. The entire 737 range accounts for almost one-third of Boeing’s operating profit.

Conclusion

There are many definitions and drivers for sustainability. I have found though that from a business perspective focusing on Risk Mitigation, Asset Maximization, and Brand Protection (not necessarily in that order) helps guide decisions and actions that are critically beneficial to organizations, management, executives, and especially sponsors and project teams. They will help increase organizational value, benefits, profitability, brand and reduce threats and costs. These are areas that management consultants and project teams can directly empower and support.

References

- Vermeulen, Freek. “Companies Don't Always Need a Purpose Beyond Profit.” Harvard Business Review, 8 May 2019, hbr.org/2019/05/companies-dont-always-need-a-purpose-beyond-profit.

- Stout, Lynn A. "The Shareholder Value Myth" (2013). Cornell Law Faculty Publications. Paper 771. http://scholarship.law.cornell.edu/facpub/771

- Watson, Ian, and Peter Prevos. “Milton Friedman on Corporate Social Responsibility.” The Lucid Manager, 14 July 2009, lucidmanager.org/milton-friedman-corporate-social-responsibility/

- Friedman, Milton. "The Social Responsibility of Business is to Increase its Profits." The New York Times, 13 September 1970, https://graphics8.nytimes.com/packages/pdf/business/miltonfriedman1970.pdf

- Schechter, Asher, et al. “It's Time to Rethink Milton Friedman's 'Shareholder Value' Argument.” Chicago Booth Review, 7 Dec. 2017, review.chicagobooth.edu/economics/2017/article/it-s-time-rethink-milton-friedman-s-shareholder-value-argument

- Milsom, Peter. “How to Use GPM's P5.” Delivering a Better World, One Project at a Time., GPM Global, 19 June 2018, www.blog.greenprojectmanagement.org/index.php/2016/09/29/gpm-p5-impact-analysis/

- “ISO 55000:2014 Asset Management -- Overview, Principles and Terminology.” ISO, ISO, 1 Mar. 2014, www.iso.org/standard/55088.html

- “ISO 20671:2019 Brand Evaluation -- Principles and Fundamentals.” ISO, ISO, 11 Mar. 2019, www.iso.org/standard/68786.html

- Griffin, Drew, et al. “5 Years after the Gulf Oil Spill: What We Do (and Don't) Know.” CNN, Cable News Network, 20 Apr. 2015, www.cnn.com/2015/04/14/us/gulf-oil-spill-unknowns/index.html

- Mufson, Steven. “BP's Big Bill for the World's Largest Oil Spill Reaches $61.6 Billion.” The Washington Post, WP Company, 14 July 2016, www.washingtonpost.com/business/economy/bps-big-bill-for-the-worlds-largest-oil-spill-now-reaches-616-billion/2016/07/14/7248cdaa-49f0-11e6-acbc-4d4870a079da_story.html?utm_term=.d9f32f9f3714

- Meigs, James B. “Blame BP for Deepwater Horizon. But Direct Your Outrage to Its Actual Mistake: Years of Cutting Corners.” Slate Magazine, Slate, 30 Sept. 2016, slate.com/technology/2016/09/bp-is-to-blame-for-deepwater-horizon-but-its-mistake-was-actually-years-of-small-mistakes.html

- Swenson, Dan. “Possible Causes of the Deepwater Horizon Explosion and BP Oil Spill.” Nola, Nola, 23 Feb. 2013, www.nola.com/news/gulf-oil-spill/2013/02/graphic_shows_how_bps_deepwate.html

- Rauwald, Christoph. “VW's Costs Keep Adding Up From Its Worst Crisis Ever.” Bloomberg, Bloomberg, 24 Feb. 2017, www.bloomberg.com/news/articles/2017-02-24/vw-s-profit-boost-clouded-by-6-8-billion-diesel-crisis-charge

- Gates, Guilbert, et al. “How Volkswagen's 'Defeat Devices' Worked.” The New York Times, The New York Times, 8 Oct. 2015, www.nytimes.com/interactive/2015/business/international/vw-diesel-emissions-scandal-explained.html

- Lauer, Klaus, and Gernot Heller. “Volkswagen Is a Bigger Threat to the German Economy than the Greek Debt Crisis.” Business Insider, Business Insider, 24 Sept. 2015, www.businessinsider.com/r-volkswagen-could-pose-bigger-threat-to-german-economy-than-greek-crisis-2015-9

- “Volkswagen Faces Shareholder Claims over Emissions Scandal.” CNBC, CNBC, 19 Jan. 2016, www.cnbc.com/2016/01/18/volkswagen-faces-shareholder-claims-over-emissions-scandal.html

-

Travis, Gregory. “How the Boeing 737 Max Disaster Looks to a Software Developer.” IEEE Spectrum, IEEE Spectrum, 10 Apr. 2019, spectrum.ieee.org/aerospace/aviation/how-the-boeing-737-max-disaster-looks-to-a-software-developer.amp.html.

-

Cassidy, John. “How Did the F.A.A. Allow the Boeing 737 Max to Fly?” The New Yorker, The New Yorker, 19 Mar. 2019, www.newyorker.com/news/our-columnists/how-did-the-faa-allow-the-boeing-737-max-to-fly.

-

Park , Kyunghee. “Boeing’s Grounded 737 Max: The Story So Far.” Bloomberg.com, Bloomberg, 2 Apr. 2019, www.bloomberg.com/news/articles/2019-04-02/boeing-s-grounded-737-max-the-story-so-far-quicktake. -

Katz, Benjamin, et al. “What’s Next for the Boeing 737 Max After Global Grounding.” Bloomberg.com, Bloomberg, 14 Mar. 2019, www.bloomberg.com/graphics/2019-boeing-737-max/

-

Liebermann, Oren. “737 Pilots Trained for Max 8 with Short Online Course.” CNN, Cable News Network, 22 Mar. 2019, www.cnn.com/2019/03/22/us/max-8-boeing-self-administered-courses-lion-air-ethiopian-airlines-intl/index.html

-

Tabuchi, Hiroko, and David Gelles. “Doomed Boeing Jets Lacked 2 Safety Features That Company Sold Only as Extras.” The New York Times, The New York Times, 21 Mar. 2019, www.nytimes.com/2019/03/21/business/boeing-safety-features-charge.html

About the Author - Peter Milsom, FCMC, GPM Global

Peter Milsom helps organizations understand what sustainability means to them, to maximize their benefits and value while minimizing costs and threats. He does this by helping organizations at all levels from the c-suite to the front lines understand what all of the elements of sustainability are, and helping them prioritize and focus on those areas that make the most sense. His area of focus in the sustainability space is change delivery or projects. Peter has also worked on a number of international standards, and is currently the Convenor of ISO 21502 Guidance on Project Management, and is the Secretary of the ISO 31000 Implementation Guidance Handbook. Peter is currently a Board Member of CMC-Ontario.

He is a contributing author: Sustainable Project Management - The GPM Reference Guide, 2nd Edition; The GPM P5 Standard for Sustainability in Project Management v1.5.

A version of the article was first published here.